As stated in my bio, I do listen to many, many podcasts. One of my favorites is the New York Time’s Ezra Klein Show. His latest episode was “The Economic Theory That Explains Why Americans Are So Mad.” He states that on a personal level, many Americans say they’re doing ok. The stock market is up, wages are beating inflation, and unemployment is historically low. Yet when surveyed, Americans say the economy is bad.

In the podcast, Klein interviewed Annie Lowrey (interestingly, his wife) who wrote “The Great Affordability Crisis Breaking America” for the February 2020 issue of the Atlantic. Here she argued that our highest expenses – housing, medical care, higher education – which were already very expensive have risen quickly. Prices, not inflation or wages, seem to determine best how people feel about the economy. So I thought I would look at some local economic metrics to test this case.

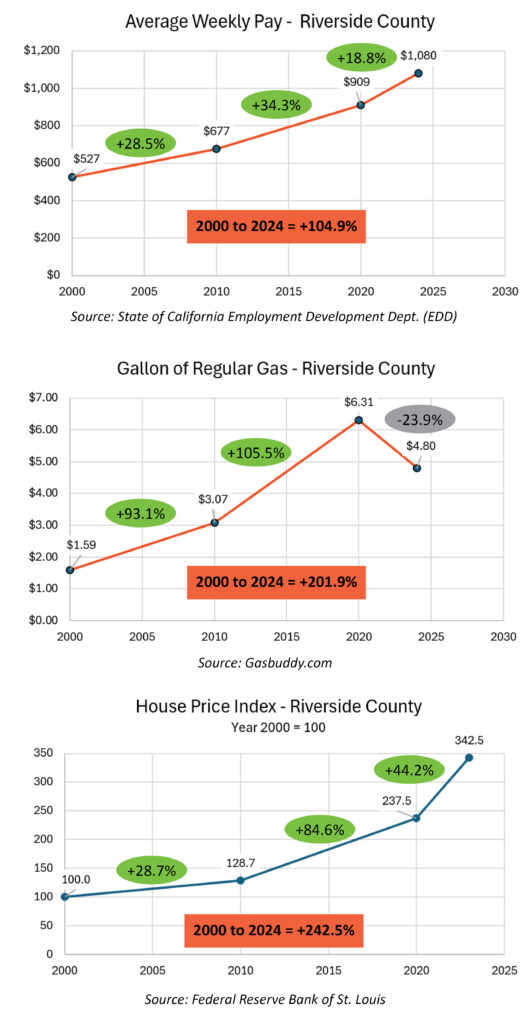

The three graphs above vividly show the underpinnings of our national economic discontent. Just compare the ten-year increases in the price of a gallon of gas and housing prices over the last two decades. In both cases, prices have increased over two times more than wages. Yes, inflation has fallen, but the high prices persist. And that’s what we see when we fill the tank or pay our rent or mortgage.

The three graphs above vividly show the underpinnings of our national economic discontent. Just compare the ten-year increases in the price of a gallon of gas and housing prices over the last two decades. In both cases, prices have increased over two times more than wages. Yes, inflation has fallen, but the high prices persist. And that’s what we see when we fill the tank or pay our rent or mortgage.

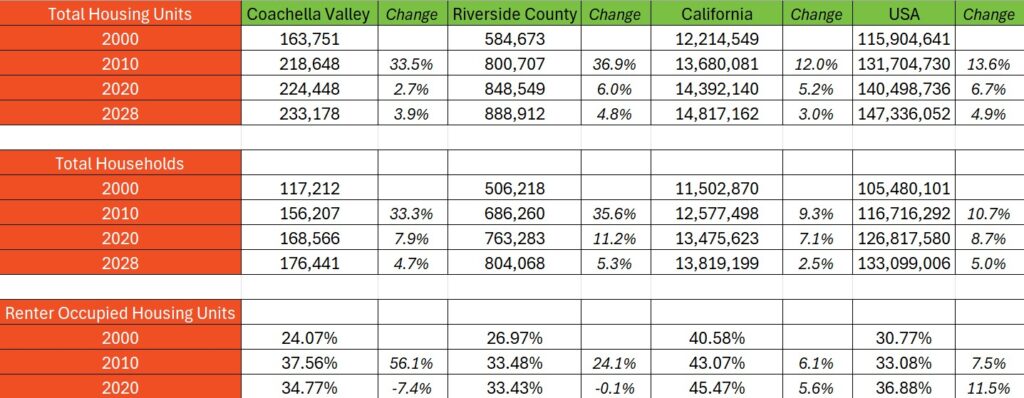

This table shows the underlying problems of sky-high housing costs. We aren’t building housing in the US to fit the demand. Economics 101 – not enough product, prices go up. We had a building boom in Riverside County and Coachella Valley between 2000 – 2010. But the 2008 Great Recession spooked builders and we’ve never recovered. Between 2010 and 2020, total households in the Coachella Valley rose 7.9% but total housing units rose only 2.7%. That translates into high housing costs, more residents cramming into one home, and more renters. This affects actual living and how we perceive our lives, not hearing the inflation number on the radio.